This article will explore how M&A Insurance works, how it can assist in a deal, and includes a glossary and FAQ at the end.

Overview of M&A Insurance

Mergers and Acquisitions (M&A) insurance is a broad term that encompasses a couple of different products:

- Warranty & Indemnity // Representations and Warranties Insurance

This is for unknown risks that were not identified in the due diligence (unknown unknowns). It does not cover identified risks.

- Contingency

This is for identified/discovered risks. And would be viewed on a case-by-case basis and whether any proceedings had already started.

- Tax

This covers identified tax risks, generally due to a unexpected tax liabilities due to differing interpretations of tax law.

These insurances are designed to protect companies from financial losses that can arise during and after a merger or acquisition and can provide a great deal of comfort to either side – and that comfort level can then help bridge the gap between buyer/seller expectations (ie final agreed sale price) or even tip a deal over the line that otherwise may have reached deadlock. At the due diligence stage, a report (information memorandum) will be completed, and this should identify any known risk factors and items of concern. Available in the Vendor Data Room.

Warranty & Indemnity Insurance

Warranty & Indemnity (W&I) insurance covers losses arising from breaches of warranties and indemnities given as part of an M&A transaction. This coverage helps protect the assets and financial health of the acquiring party.

In video game industry M&As, warranties often cover intellectual property rights, software code integrity, and compliance with relevant digital media laws.

Case Study: Protecting Intellectual Property

An example includes a gaming company acquiring another firm where W&I insurance covered undisclosed intellectual property disputes that emerged post-acquisition. It is key to note that these issues were not picked up through the due diligence process.

It is usually purchased by the buyers, but either side can buy it.

In a buyer-side policy, the buyer is the one who obtains the insurance. This allows the buyer to directly claim compensation from the insurer for any losses that result from the seller breaching a warranty. Generally, this policy is designed to cover the buyer’s losses that exceed the limit of the seller’s liability as stipulated in the Sale and Purchase Agreement (SPA).

Conversely, in a seller-side policy, it is the seller who secures the insurance. This policy kicks in when a buyer makes a claim against the seller for a warranty breach, usually covering up to the liability limit specified in the SPA. The insurer typically assumes responsibility for defending the warranty claim. This includes covering the costs of defence and any investigative efforts, as well as compensating the seller for any adjudicated liability.

Key Coverage Areas

This insurance typically covers financial statements accuracy, material contracts, compliance with laws, tax affairs, and intellectual property issues.

It generally does not cover identified risks. So if there is anything flagged on the due diligence report, insurers will exclude this and you may look towards Contingency insurance for this.

For buyers, W&I insurance provides protection against misrepresentations by the seller. For sellers, it offers a clean exit by reducing post-sale liabilities.

Contingency Insurance

Contingency insurance covers specific risks that have been identified as part of a transaction and would therefore not typically covered by W&I/RWI insurance.

An example of this could be a claim of ownership over IP from a 3rd party that was still ongoing during the transaction but not fully resolved yet. This could have a very small chance of succeeding, but if upheld could zero the value of a transaction. Any buyer would be naturally worried about this so could purchase a contingency policy to take that risk off the table.

Getting this insurance can be a bit more of an involved process as the insurers would need to play detective, and investigate the circumstances and parties involved and make their own decision of the likelihood of something being upheld, and then put a price on it.

After-The-Event Insurance.

This is a subset of Contingency insurance that covers active litigation. Where an issue has happened, and proceedings have been initiated. Insurers will assess the likelihood of success and attempt to put a price on insuring the outcome. This is very niche and can be more expensive than just dealing with it yourself, however it does provide some cost certainty.

Tax Insurance

Tax insurance is specifically designed to protect against potential tax liabilities that might arise from interpretations of tax laws or disputes with tax authorities after an M&A transaction.

A tax contingency insurance claim might be triggered by disputes or assessments from tax authorities that challenge the tax treatment of a transaction, unexpected tax liabilities arising from interpretations of tax law, or issues with the execution of tax strategies that were thought to be compliant. This typically includes situations where the actual tax implications differ significantly from those anticipated at the time the insurance was purchased, leading to additional tax costs.

Coverage of Tax-Related Risks

It covers risks such as challenges to tax treatments, unexpected tax liabilities, and issues related to transfer pricing.

Strategic Benefits to Parties Involved

Tax insurance helps make transactions more appealing by mitigating the risks associated with uncertain tax positions, which can be a major deal-breaker.

Best Practices in Utilizing M&A Insurance in the Video Game Industry

Due Diligence Processes

Comprehensive due diligence is crucial for identifying risks that can be insured against, particularly in understanding the specific challenges of the gaming sector.

Integrating Insurance into Strategic Planning

Incorporating insurance solutions into the broader M&A strategy helps ensure that all potential risks are addressed, making the deal structure more robust.

Negotiating Insurance Terms Specific to Industry Needs

Customizing insurance policies to the specific needs of the video game industry, such as intellectual property rights and software development risks, is essential for effective coverage.

State of the Games M&A market in 2024

See this attached article (TBA)

Does M&A Insurance actually pay out??

Insurers we have worked with have paid tens of millions of dollars in claims, of which the largest single settlement was just under USD 10m.

In our experience, most claims have been resolved swiftly. When claims have taken longer to resolve, the following factors have been relevant:

Of the claims that we are able to resolve more quickly, most relate to tax breaches, the quantum of which will often be known at an early stage.

Be aware that policy exclusions may apply and we would encourage that you check your policies and work with a broker to clearly identify and become comfortable with any exclusions.

Examples of actual claims paid.

- Overstatement of good will and Seller fraud

- Late recognition of expenses

- Accounting inaccuracies for major project labour costs and capitalising of expenses

- Intention to terminate major customer contract

- Undisclosed interest of Target’s shares by a group company

Overstatement of work in progress and understatement of labour costs

Jargon Busting M&A Terms and Frequently Asked Questions:

How to get these insurances?

Generally through a broker, either go direct to one or ask for a recommendation from your advisors.

A broker specialised in your industry may provide a better service and insight. Ultimately it is the insurer who provides the insurance product, so pick a broker you trust, and feel they will give you the best attention. Generally, they should all have access to many of the same insurers. Brokers are paid either a commission from the insurer and/or will charge a fee to the client. If a broker charges a fee, don’t assume they are not taking a commission from the insurer also.

Could I just hide an issue and hope it doesn’t come up?

Yes, but this would not only be a breach of good faith, if insurers found out you knew about it the insurance certainly wouldn’t pay out and you would be SOL…

SOL:

Liable and uninsured.

Equity Value:

Equity value is the value of a company available to owners or shareholders. It is the enterprise value plus all cash and cash equivalents, short and long-term investments, minus all short-term debt, long-term debt and minority interests.

Enterprise Value:

Enterprise Value (EV) is the measure of a company’s total value. EV can be thought of as the effective cost of buying a company or the theoretical price of a target company (before a takeover premium is considered).

A simple formula for enterprise value is:

EV = Market Capitalization + Market Value of Debt – Cash and Equivalents

A more comprehensive formula is:EV = Common Shares + Preferred Shares + Market Value of Debt + Noncontrolling Interest – Cash and Equivalents

EBITDA:

EBITDA full form stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It is a common way to assess the value of a company, and a sale price is often expressed as a multiple of EBITDA.

Typically, there are two formulas that can be used;

EBITDA = Net Profit + Interest + Taxes + Depreciation + Amortization

EBITDA = Operating Income + Depreciation + Amortization

Is it better to value a company based in Enterprise Value or a Multiple of EBITDA?

If the goal is to compare companies within the same sector, using a multiple of EBITDA can be quick and effective. It allows for comparisons free from distortions caused by different capital structures and non-operating factors.

If you’re considering an acquisition, EV is more appropriate because it gives you the total cost of acquiring the company, including taking over its debt. For investors, looking at EV in conjunction with EBITDA multiples provides a clear picture. This combined approach helps in understanding not just what the company earns operationally (EBITDA) but also the total value of the company in the marketplace (EV).

Policy Limit vs Policy aggregate:

The policy limit is how much the insurance could pay out for one single claim.

The policy aggregate is how much the insurance could pay out over the entire life of the policy. If you have a limit of $10mil and an aggregate of $100mil, you could have 10 claims of $10mil, but if you had a single claim of $15mil, the policy would remain capped at $10mil for that single claim.

Discovery Period:

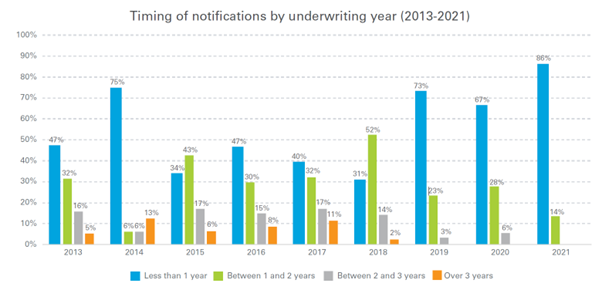

The discovery period refers to a specified time frame after the policy’s initial term during which the insured can still report claims for breaches that occurred during the policy term but were only discovered after it ended. For example you could have a policy period of 2 years but a discovery period of 5 additional years. As you will see from the below, in terms of notifications, most come in the first 2 years, with not may after 3.

When to notify a potential claim?

As soon as possible, even if you have minimal information, as it “locks in” the loss at that date.

What is a Data Room:

A vendor data room, also commonly referred to as a seller data room in the context of mergers and acquisitions (M&A), is a centralized repository where a seller organizes and stores critical documents related to the business being sold. This digital or physical space allows potential buyers to review pertinent business information efficiently during the due diligence process.

Key Features of a Vendor Data Room:

- Confidentiality: Access to the data room is strictly controlled and monitored to ensure that only authorized parties can view the sensitive documents.

- Organization: Documents are usually well-organized into categories such as legal, financial, operational, and human resources, making it easier for due diligence teams to find the information they need.

- Security: In digital data rooms, advanced security measures are in place to protect the data, including encryption, secure login procedures, and the ability to track who accesses what information and when.

- Efficiency: By centralizing information, a vendor data room speeds up the due diligence process, allowing potential buyers to access all necessary documents in one place without the need for multiple information requests.

The purpose of a vendor data room is to provide transparency, build trust between the seller and potential buyers, and facilitate a smoother transaction by ensuring that all parties have access to the same comprehensive set of data.

Information Memorandum:

An Information Memorandum (IM) is a comprehensive document typically prepared by a company or its advisors primarily for use in private sales and financing transactions, including mergers and acquisitions. This document provides potential buyers, investors, or lenders with detailed information about the business to assist them in making an informed decision regarding an investment or purchase.

Exit:

In the context of business and finance, an “exit” refers to a strategy or event through which an investor or business owner aims to sell their stake in a company to realize a profit or limit losses.

Earnout:

An earnout is a contractual provision in a business acquisition agreement where additional payment is made to the sellers, contingent upon the acquired business achieving certain predefined financial goals or milestones post-acquisition. This payment is typically tied to the future performance of the business, such as reaching specific revenue targets or profitability metrics, and is used to align the interests of the buyer and seller, potentially bridging the gap between differing valuations during negotiations. This would not protect the sellers from market downturns or other factors outside of their control, so can be a risky strategy for the sellers.

Rollover:

In the context of an SPA, “rollover” usually refers to the arrangement where certain stakeholders (like the management team or key employees) are required or incentivized to “roll over” or reinvest some portion of their equity into the acquiring entity or a new entity formed as a result of the acquisition. This is common in deals where the buyer values the ongoing involvement and longer-term commitment of key creators or managers who are pivotal due to their skills or knowledge of the industry.

SPA = share purchase agreement:

A Share Purchase Agreement (SPA) is the legal contract that outlines the terms and conditions of a transaction where shares of a company are sold from one party to another. The agreement includes details such as the number of shares being sold, the price per share, warranties, representations, and conditions that must be met before the transaction can be completed. This document is essential in ensuring that all parties agree on the specifics of the share transfer and their respective obligations.

TRI = Transaction Risk Insurance:

This is another interchangeable name for Mergers & Acquisitions Insurance and Transaction Liability Insurance, themselves being broad terms encompassing W&I/Reps and Warranties, Contingency, and Tax Insurance

Is there a difference between Warranty & Indemnity (W&I) and Representation and Warranties Insurance (RWI)?

Warranty & Indemnity (W&I) insurance and Representations & Warranty (R&W) insurance essentially cover similar risks and are often used interchangeably as they essentially serve the same purpose. However, there are subtle regional nuances and slight differences in how these terms are used and understood, primarily due to the geographic contexts in which they are most commonly applied.

Similarities:

- Purpose: Both insurances aim to provide protection against the risks of inaccuracies in the representations and warranties made during M&A transactions. They help facilitate transactions by providing a safety net that can make a deal more attractive to both buyers and sellers.

- Coverage: They cover costs associated with legal claims and financial losses that occur when a breach of a warranty or representation is discovered after the completion of the transaction.

Nuances and Differences:

- Terminology and Regional Preference:

- Warranty & Indemnity Insurance is the term more frequently used in Europe, Australia, and parts of Asia.

- Representations & Warranty Insurance is predominantly used in the United States and Canada. The slight difference in terminology reflects not just regional language preferences but also can influence the specific legal interpretations and the structure of the policies based on local legal practices.

- Scope and Focus:

- While both types of insurance cover similar issues, there can be nuances in terms of what exactly is covered and how these terms are defined in the policies, which can be influenced by the legal frameworks and business practices predominant in the region. For example, the definition of what constitutes a “representation” versus a “warranty” can vary significantly between jurisdictions and this affects the scope of coverage.

- Market Maturity:

- The R&W insurance market in the U.S. is more mature, which may mean broader coverage options and more competitive pricing, as well as a larger number of claims precedents that can guide expectations and policy terms.

- The W&I market in Europe, while mature, may have different underwriting criteria and a different approach to exclusions and policy limits, influenced by European commercial law and practices.

- Underwriting Process:

- There may be differences in the underwriting process and the depth of due diligence required before a policy is issued. These differences are often influenced by typical transaction structures and the legal requirements in each region.

In practice, while the basic concept and purpose of W&I and R&W insurance are aligned, advisors and companies operating in international contexts should be aware of these nuances and consider how local practices and legal interpretations could impact the coverage and effectiveness of these insurance policies in their specific transaction. It’s always advisable to consult with legal and insurance professionals who are knowledgeable about the specific conditions and practices of the regions involved in any cross-border transaction.

Thanks for reading, we hope you found this article useful.

Interested in buying/selling your company…? Talk to us for discreet advice and introductions.